.png)

Enhanced Approvals with Decline Recovery

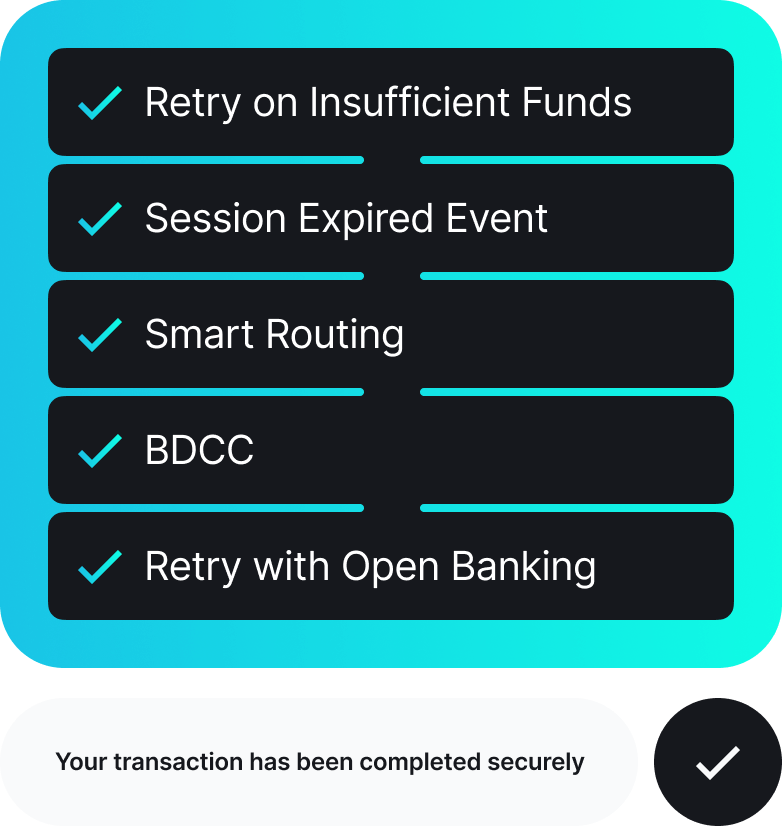

Leverage our suite for optimal transaction flow. With Smart Routing, insufficient funds retries, open banking options, background currency conversion, and session alerts, our comprehensive suite of features are key to your consistent payment success and customer satisfaction.

Grow With Us

Grow With Us

up to 90%

Increased Approvals

24%

Recaptured Transactions

payment SHIELD

Ensured Transactions

Businesses of all sizes confront the challenges of transaction declines. Drawing from data-driven insights, our solutions identify common decline patterns and effectively rectify them, enhancing your approval rates. Already incorporated across varied industries and scales, our methods address the unique needs of each sector, ensuring transactions that otherwise may have been declined are saved.

Protect Your Payments

Protect Your Payments

Our Comprehensive Suite of Features

Retry on Insufficient Funds

Our immediate alternative suggestions come to the rescue. Enhance the user journey by presenting real-time lesser amounts, ensuring you don’t lose the transaction.

Abandoned Session Events

Be notified if a customer abandons the deposit page or if they see a failed transaction and never come back. Use the data to react, and bring the customer back through generating a payment link and sending it by SMS or email to your customer.

Smart Routing

Navigate the transaction highway with intelligence. Our dynamic routing system evaluates and selects the prime gateway based on intricate rules controlled by you, effectively optimizing every transaction's success potential.

BDCC

With our Background Dynamic Currency Conversion (BDCC) feature, payments become straightforward. It allows your customers to pay using their local currency and view the current market exchange rates, ensuring transparency. It’s that smooth.

Retry with

Open Banking

In the event of card transaction failures, our system will immediately offer the end-user alternative trusted payment methods using Open and Online Banking. A reliable fallback ensuring every transaction gets a second shot at approval.

Addressing Real-World Merchant Challenges

“I’m incredibly proud of how we’ve tailored our solutions to address real-world merchant challenges. Whether big or small, we’ve engineered processes to ensure every customer transaction has the highest chance of approval.”

Guy Karsenti

Chief Technology Officer

Explore how Praxis Tech can support your business

Let’s talk.

You might also be interested in

You might also be interested in

Retry on Insufficient Funds

Give your customers a second change to make a payment if the transaction fails due to insufficient funds in their account.

Retry with Open Banking

Incorporate the latest industry data-sharing practices into your payment suite by utilizing the latest open banking-based card cascading methods.

Cashier

Connect with global service providers and tap into a full-stack suite of pre-integrated payment solutions through a feature-packed back-office.