.png)

Bridging Currency Gaps with BDCC

Leveraging the latest industry data-sharing practices, our advanced integration utilizes contemporary open banking-based cascading methods to convert failed transactions into successful ones, enhancing payment efficiency and customer satisfaction.

Grow With Us

Grow With Us

200+

Currencies

13%

Increased Approvals

100%

Configurable Controls

Your Cashier Supercharged

Dynamic Currency Adaptation

Handling multiple currencies in international transactions often leads to customer confusion and lost sales. BDCC transforms this experience. Customers view and pay in their own currency, while our system seamlessly handles conversions in the background for higher approval rates. Plus, BDCC is customizable to match your specific business requirements.

Empowering Global Commerce

Empowering Global Commerce

4 Integral Components.

Background Currency

Identification

As soon as a transaction is initiated, BDCC probes it for currency details. It checks whether the transaction's currency is supported by the chosen gateway.

Configurable Settings

BDCC isn't a one-size-fits-all tool and you aren't left in the dark. The system provides controls at both the application and gateway levels. You decide which currencies you want BDCC to manage, and how. Our intuitive interface grants you complete control over its operation.

Increased Transaction Approvals

By converting transactions to supported currencies in the background, BDCC expands your gateway options. This means fewer skipped gateways and higher approval rates for international transactions.

Transaction Confirmation Mechanism

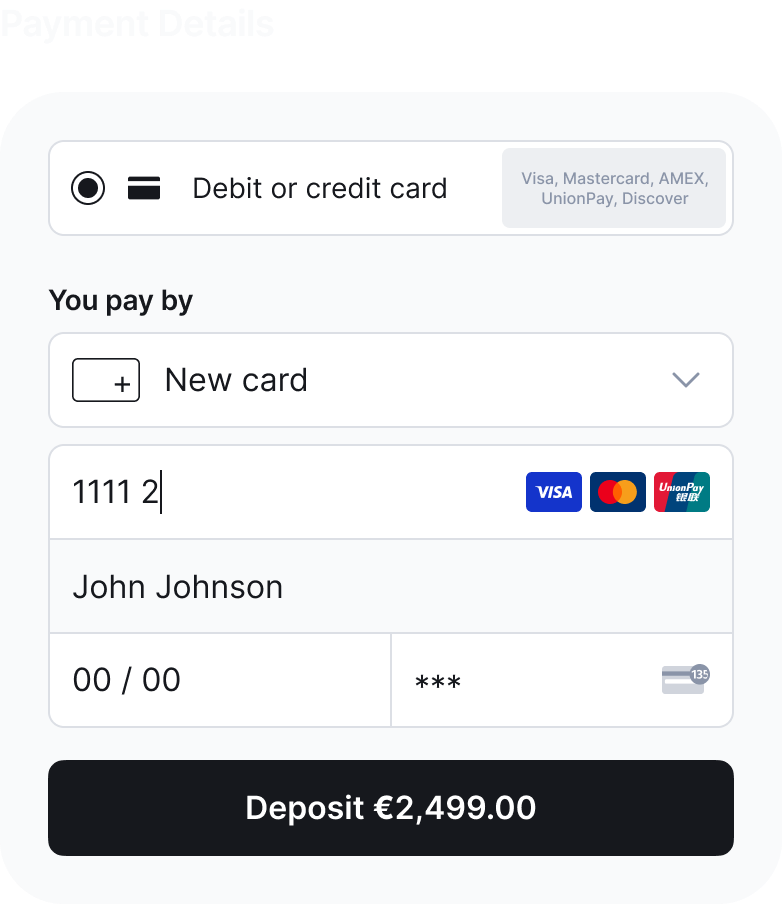

Transparency is key. When BDCC is applied to a transaction, an optional confirmation screen can be displayed to the customer, providing clarity and maintaining trust.

advanced exchange management

Comprehensive Currency Support

BDCC is more than just a tool; it's a business enabler. By handling the intricacies of currency conversion, it ensures that even if a gateway doesn't support a particular currency it won’t be excluded from cascading. With BDCC, your business is always open to the world, welcoming customers from all corners, ensuring they enjoy a transparent and efficient payment experience.

.png)

Explore how Praxis Tech can support your business

Let’s talk.

You might also be interested in

You might also be interested in

Merchant Initiated Transactions

Initiate transactions on your customers' behalf and accept recurring and one-click payments, or introduce support for automatic top-ups.

Smart Routing

Navigate transactions intelligently and enhance your approvals by routing your payments through the most optimized pathways available.

Decline Recovery

Benefit from our advanced features that help you recapture transactions and boost your payment approval ratios.